A) was commodity money.

B) had no intrinsic value.

C) was fiat money.

D) had no store of value.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose banks decide to hold more excess reserves relative to deposits. Other things the same, this action will cause the

A) money supply to fall. To reduce the impact of this the Fed could lower the discount rate.

B) money supply to fall. To reduce the impact of this the Fed could raise the discount rate.

C) money supply to rise. To reduce the impact of this the Fed could lower the discount rate.

D) money supply to rise. To reduce the impact of this the Fed could raise the discount rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Imagine an economy in which: (1) pieces of paper called dollars are the only thing that buyers give to sellers when they buy goods and services, so it would be common to use, say, 50 dollars to buy a pair of shoes; (2) prices are posted in terms of yardsticks, so you might walk into a grocery store and see that, today, an apple is worth 2 yardsticks; and (3) yardsticks disintegrate overnight, so no yardstick has any value for more than 24 hours. In this economy,

A) the yardstick is a medium of exchange but it cannot serve as a unit of account.

B) the yardstick is a unit of account but it cannot serve as a store of value.

C) the yardstick is a medium of exchange but it cannot serve as a store of value, and the yollar is a unit of account.

D) the yollar is a unit of account, but it is not a medium of exchange and it is not a liquid asset.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve increases the interest rate on bank deposits at the Fed, banks will want to hold

A) fewer reserves, so the reserve ratio will fall.

B) fewer reserves, so the reserve ratio will rise.

C) more reserves, so the reserve ratio will fall.

D) more reserves, so the reserve ratio will rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To decrease the money supply, the Fed can

A) buy government bonds or increase the discount rate.

B) buy government bonds or decrease the discount rate.

C) sell government bonds or increase the discount rate.

D) sell government bonds or decrease the discount rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 12.5 percent, then $1,000 of additional reserves can create up to

A) $7,000 of new money.

B) $8,000 of new money.

C) $11,500 of new money.

D) $12,500 of new money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

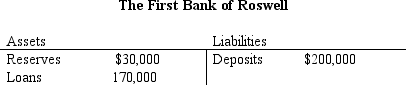

Table 29-5.  -Refer to Table 29-5. If the bank faces a reserve requirement of 8 percent, then the bank

-Refer to Table 29-5. If the bank faces a reserve requirement of 8 percent, then the bank

A) is in a position to make a new loan of $14,000.

B) has fewer reserves than are required.

C) has excess reserves of $16,400.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Any item that people can use to transfer purchasing power from the present to the future is called

A) a medium of exchange.

B) a unit of account.

C) a store of value.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the Great Depression in the early 1930s,

A) bank runs closed many banks.

B) the money supply rose sharply.

C) the Fed decreased reserve requirements.

D) both a and b are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not included in either M1 or M2?

A) U.S. Treasury bills

B) small time deposits

C) demand deposits

D) money market mutual funds

Correct Answer

verified

Correct Answer

verified

True/False

Members of the Board of Governors of the Federal Reserve System are appointed for life.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 5 percent, then $1,000 of additional reserves can create up to

A) $5,500 of new money.

B) $5,000 of new money.

C) $4,000 of new money.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the public decides to hold more currency and fewer deposits in banks, bank reserves

A) decrease and the money supply eventually decreases.

B) decrease but the money supply does not change.

C) increase and the money supply eventually increases.

D) increase but the money supply does not change.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bank capital is

A) the machinery, structures, and equipment of the bank.

B) the resources that owners have put into the bank.

C) the reserves of the bank.

D) the bank's total assets.

Correct Answer

verified

Correct Answer

verified

True/False

Other things the same, if banks decide to hold a smaller part of their deposits as excess reserves, the money supply will fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

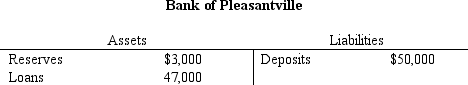

Table 29-6.  -Refer to Table 29-6. The Bank of Pleasantville's reserve ratio is

-Refer to Table 29-6. The Bank of Pleasantville's reserve ratio is

A) 6.4 percent.

B) 16.7 percent.

C) 6.0 percent.

D) 15.7 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The set of items that serve as media of exchange clearly includes

A) balances that lie behind debit cards.

B) demand deposits.

C) other checkable deposits.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

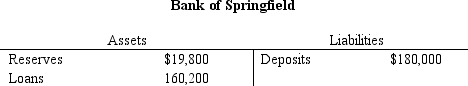

Table 29-7.  -Refer to Table 29-7. If the Fed requires a reserve ratio of 6 percent, then what quantity of excess reserves does the Bank of Springfield now hold?

-Refer to Table 29-7. If the Fed requires a reserve ratio of 6 percent, then what quantity of excess reserves does the Bank of Springfield now hold?

A) $9,600

B) $10,800

C) $10,200

D) $9,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money

A) is a perfect store of value.

B) is the most liquid asset.

C) has intrinsic value, regardless of which form it takes.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed can influence unemployment in

A) the short run and in the long run.

B) the short run, but not in the long run.

C) the long run, but not in the short run.

D) neither the short nor the long run.

Correct Answer

verified

Correct Answer

verified

Showing 421 - 440 of 515

Related Exams