A) $9,800

B) $(27,400)

C) $15,400

D) $5,600

Correct Answer

verified

Correct Answer

verified

Multiple Choice

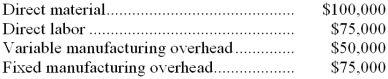

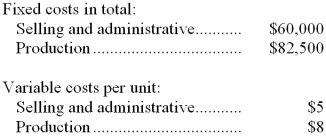

Walsh Company produces a single product. Last year, the company manufactured 25,000 units and sold 22,000 units. Production costs were as follows:  Sales totaled $440,000, variable selling and administrative expenses were $110,000, and fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-Under absorption costing, the unit product cost would be:

Sales totaled $440,000, variable selling and administrative expenses were $110,000, and fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-Under absorption costing, the unit product cost would be:

A) $9.00

B) $12.00

C) $13.40

D) $14.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

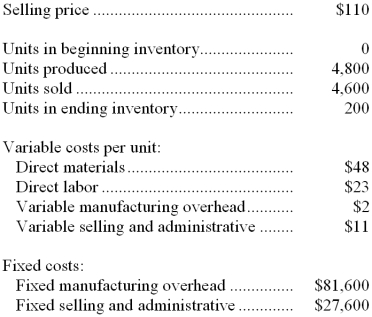

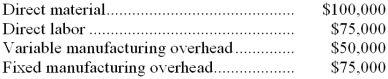

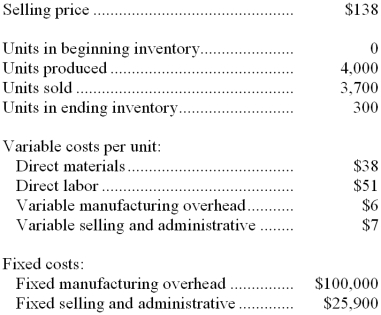

Clubb Company, which has only one product, has provided the following data concerning its most recent month of operations:  -The total gross margin for the month under the absorption costing approach is:

-The total gross margin for the month under the absorption costing approach is:

A) $110,000

B) $92,000

C) $119,600

D) $13,800

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The gross margin for a manufacturing company is the excess of sales over:

A) cost of goods sold, excluding fixed manufacturing overhead.

B) all variable costs, including variable selling and administrative expenses.

C) cost of goods sold, including fixed manufacturing overhead.

D) variable costs, excluding variable selling and administrative expenses.

Correct Answer

verified

Correct Answer

verified

True/False

Since variable costing emphasizes costs by behavior, it works well with cost-volume-profit analysis.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

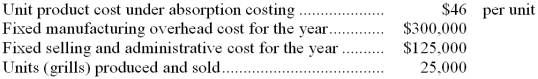

Charrd Corporation manufactures a gas operated barbecue grill. The following information relates to Charrd's operations for last year:  What is Charrd's variable costing unit product cost?

What is Charrd's variable costing unit product cost?

A) $29

B) $34

C) $58

D) $63

Correct Answer

verified

Correct Answer

verified

Multiple Choice

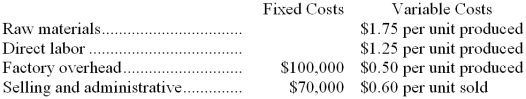

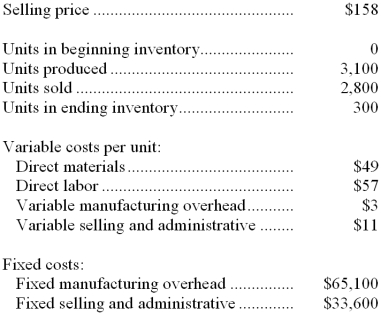

Indiana Corporation produces a single product that it sells for $9 per unit. During the first year of operations, 100,000 units were produced and 90,000 units were sold. Manufacturing costs and selling and administrative expenses for the year were as follows:  What was Indiana Corporation's net operating income for the year using variable costing?

What was Indiana Corporation's net operating income for the year using variable costing?

A) $181,000

B) $271,000

C) $281,000

D) $371,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Erie Company manufactures a single product. Assume the following data for the year just completed:  There were no units in inventory at the beginning of the year. During the year 30,000 units were produced and 25,000 units were sold. Each unit sells for $35.

-Under absorption costing, the unit product cost would be:

There were no units in inventory at the beginning of the year. During the year 30,000 units were produced and 25,000 units were sold. Each unit sells for $35.

-Under absorption costing, the unit product cost would be:

A) $8.00

B) $17.75

C) $13.00

D) $10.75

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Walsh Company produces a single product. Last year, the company manufactured 25,000 units and sold 22,000 units. Production costs were as follows:  Sales totaled $440,000, variable selling and administrative expenses were $110,000, and fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-The contribution margin per unit would be:

Sales totaled $440,000, variable selling and administrative expenses were $110,000, and fixed selling and administrative expenses were $45,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-The contribution margin per unit would be:

A) $15.00

B) $11.00

C) $8.00

D) $6.00

Correct Answer

verified

Correct Answer

verified

Multiple Choice

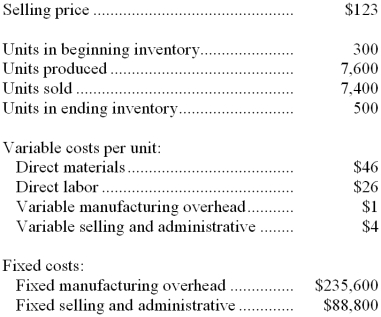

Dearman Company, which has only one product, has provided the following data concerning its most recent month of operations:  -What is the total period cost for the month under the absorption costing approach?

-What is the total period cost for the month under the absorption costing approach?

A) $33,600

B) $65,100

C) $129,500

D) $64,400

Correct Answer

verified

Correct Answer

verified

Essay

Soffer Corporation manufactures a variety of products. Last year, variable costing net operating income was $72,000. The fixed manufacturing overhead costs released from inventory under absorption costing amounted to $24,000. Required: Determine the absorption costing net operating income last year. Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

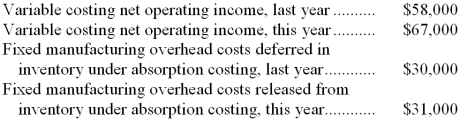

Botwinick Corporation manufactures a variety of products. The following data pertain to the company's operations over the last two years:  -What was the absorption costing net operating income last year?

-What was the absorption costing net operating income last year?

A) $57,000

B) $28,000

C) $58,000

D) $88,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Atlantic Company produces a single product. For the most recent year, the company's net operating income computed by the absorption costing method was $7,400, and its net operating income computed by the variable costing method was $10,100. The company's unit product cost was $17 under variable costing and $22 under absorption costing. If the ending inventory consisted of 1,460 units, the beginning inventory must have been:

A) 920 units

B) 1,460 units

C) 2,000 units

D) 12,700 units

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Schrick Inc. manufactures a variety of products. Variable costing net operating income was $86,800 last year and ending inventory increased by 1,900 units. Fixed manufacturing overhead cost was $6 per unit. What was the absorption costing net operating income last year?

A) $86,800

B) $75,400

C) $98,200

D) $11,400

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming that direct labor is a variable cost, product costs under variable costing include only:

A) direct materials and direct labor.

B) direct materials, direct labor, and variable manufacturing overhead.

C) direct materials, direct labor, variable manufacturing overhead, and variable selling and administrative expenses.

D) direct material, variable manufacturing overhead, and variable selling and administrative expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costs at a sofa manufacturing company would be treated as a period cost under the variable costing method?

A) the cost of glue used to assemble the wood frame of each sofa produced

B) depreciation on sales vehicles

C) the salary of a factory manager

D) both B and C above

Correct Answer

verified

Correct Answer

verified

True/False

Under variable costing, product cost contains some fixed manufacturing overhead cost.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the total period cost for the month under variable costing?

What is the total period cost for the month under variable costing?

A) $151,800

B) $51,800

C) $100,000

D) $125,900

Correct Answer

verified

Correct Answer

verified

Essay

Neuman Company, which has only one product, has provided the following data concerning its most recent month of operations:  The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a. Prepare a contribution format income statement for the month using variable costing.

b. Prepare an income statement for the month using absorption costing.

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a. Prepare a contribution format income statement for the month using variable costing.

b. Prepare an income statement for the month using absorption costing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) Expenses are not usually separated into variable and fixed elements in externally reported income statements.

B) Even if there is no change in units sold, selling price, or cost structure, a company can increase its absorption costing net operating income from one year to the next just by producing more units.

C) When finished goods inventory decreases during a period, a manufacturing company's absorption costing net operating income for that period will usually be greater than its variable costing net operating income.

D) Both A and B above.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 136

Related Exams