A) deposit more into interest-bearing accounts,and the interest rate will fall.

B) deposit more into interest-bearing accounts,and the interest rate will rise.

C) withdraw money from interest-bearing accounts,and the interest rate will fall.

D) withdraw money from interest-bearing accounts,and the interest rate will rise.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions might we logically expect to result from rising stock prices?

A) Jim decreases his consumption spending.

B) Firms sell fewer shares of new stock.

C) Firms spend more on investment.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following sequence of events: Price level ↑ ⇒ demand for money ↑ ⇒ equilibrium interest rate ↑ ⇒ quantity of goods and services demanded ↓ Τhis sequence explains why the

A) money-supply curve is vertical.

B) aggregate-demand curve shifts leftward in response to a monetary injection.

C) aggregate-demand curve shifts rightward in response to a monetary injection.

D) aggregate-demand curve slopes downward.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

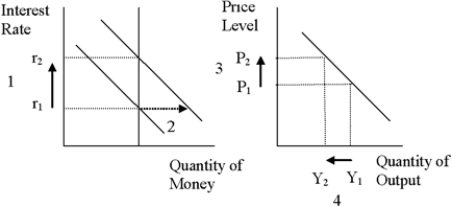

Figure 34-3.  -Refer to Figure 34-3.Which of the following sequences (numbered arrows) shows the logic of the interest-rate effect?

-Refer to Figure 34-3.Which of the following sequences (numbered arrows) shows the logic of the interest-rate effect?

A) 1,2,3,4

B) 1,4,3,2

C) 3,4,2,1

D) 3,2,1,4

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recent years,the Federal Reserve has conducted policy by setting a target for

A) bank reserves.

B) the monetary growth rate.

C) the exchange rate.

D) the federal funds rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed can influence the money supply by

A) changing how much it lends to banks.

B) changing the interest rate it pays banks on the reserves they are holding.

C) using open-market operations.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve increases the money supply,then initially people want to

A) sell bonds so the interest rate rises.

B) sell bonds so the interest rate falls.

C) buy bonds so the interest rate rises.

D) buy bonds so the interest rate falls.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recent years,the Federal Reserve has conducted policy by setting a target for the

A) size of the money supply.

B) growth rate of the money supply.

C) federal funds rate.

D) discount rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory,an increase in the price level causes the interest rate to

A) increase,which increases the quantity of goods and services demanded.

B) increase,which decreases the quantity of goods and services demanded.

C) decrease,which increases the quantity of goods and services demanded.

D) decrease,which decreases the quantity of goods and services demanded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory,a decrease in the price level causes the interest rate to

A) increase,which increases the quantity of goods and services demanded.

B) increase,which decreases the quantity of goods and services demanded.

C) decrease,which increases the quantity of goods and services demanded.

D) decrease,which decreases the quantity of goods and services demanded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate is above the Fed's target,the Fed should

A) buy bonds to increase the money supply.

B) buy bonds to decrease the money supply.

C) sell bonds to increase the money supply.

D) sell bonds to decrease the money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following shifts aggregate demand to the right?

A) The price level rises.

B) The price level falls.

C) The Fed purchases government bonds on the open market.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the short run,a decrease in the money supply causes interest rates to

A) increase,and aggregate demand to shift right.

B) increase,and aggregate demand to shift left.

C) decrease,and aggregate demand to shift right.

D) decrease,and aggregate demand to shift left.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

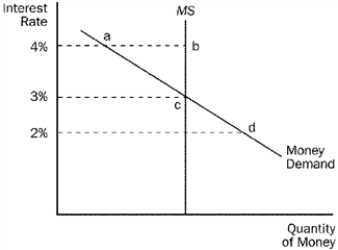

Figure 34-1  -Refer to Figure 34-1.If the current interest rate is 2 percent,

-Refer to Figure 34-1.If the current interest rate is 2 percent,

A) there is an excess supply of money.

B) people will sell more bonds,which drives interest rates up.

C) as the money market moves to equilibrium,people will buy more goods.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed conducts open-market purchases,then which of the following quantities increase(s) ?

A) interest rates and investment spending

B) interest rates,but not investment spending

C) investment spending,but not interest rates

D) neither interest rates nor investment spending

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same,which of the following responses would we expect to result from a decrease in U.S.interest rates?

A) U.S.citizens decide to hold more foreign bonds.

B) People choose to hold more currency.

C) You decide to purchase a new oven for your cookie factory.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

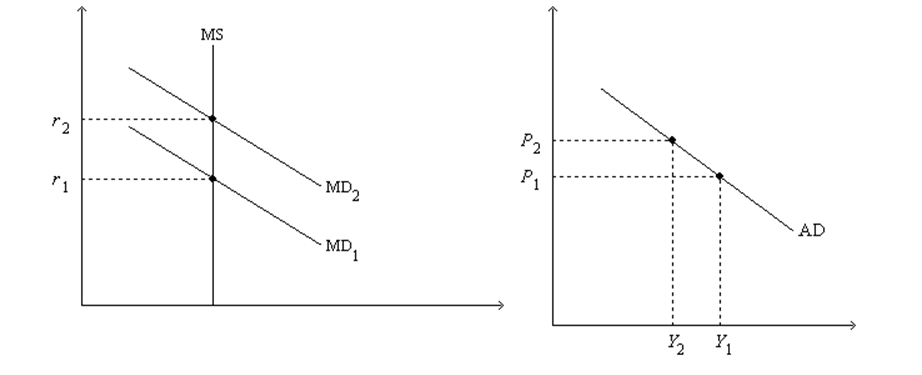

Figure 34-2.On the left-hand graph,MS represents the supply of money and MD represents the demand for money;on the right-hand graph,AD represents aggregate demand.The usual quantities are measured along the axes of both graphs.

.  -Refer to Figure 34-2.If the graphs apply to an economy such as the U.S.economy,then the slope of the AD curve is primarily attributable to the

-Refer to Figure 34-2.If the graphs apply to an economy such as the U.S.economy,then the slope of the AD curve is primarily attributable to the

A) wealth effect.

B) interest-rate effect.

C) exchange-rate effect.

D) Fisher effect.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve decreases the money supply,then initially there is a

A) shortage in the money market,so people will want to sell bonds.

B) shortage in the money market,so people will want to buy bonds.

C) surplus in the money market,so people will want to sell bonds.

D) surplus in the money market,so people will want to buy bonds.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate is below the Fed's target,the Fed would

A) buy bonds to increase the money supply.

B) buy bonds to decrease the money supply.

C) sell bonds to increase the money supply.

D) sell bonds to decrease the money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed is concerned about stock market booms because the booms

A) increase consumption spending.

B) increase investment spending.

C) increase both consumption and investment spending.

D) None of the above is correct.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 198

Related Exams