A) 9.32%

B) 9.82%

C) 10.33%

D) 10.88%

E) 11.42%

Correct Answer

verified

Correct Answer

verified

True/False

One problem with ratio analysis is that relationships can be manipulated. For example, we know that if our current ratio is less than 1.0, then using some of our cash to pay off some of our current liabilities would cause the current ratio to increase and thus make the firm look stronger.

Correct Answer

verified

Correct Answer

verified

True/False

Suppose Firms A and B have the same amount of assets, pay the same interest rate on their debt, have the same basic earning power (BEP), and have the same tax rate. However, Firm A has a higher debt ratio. If BEP is greater than the interest rate on debt, Firm A will have a higher ROE as a result of its higher debt ratio.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

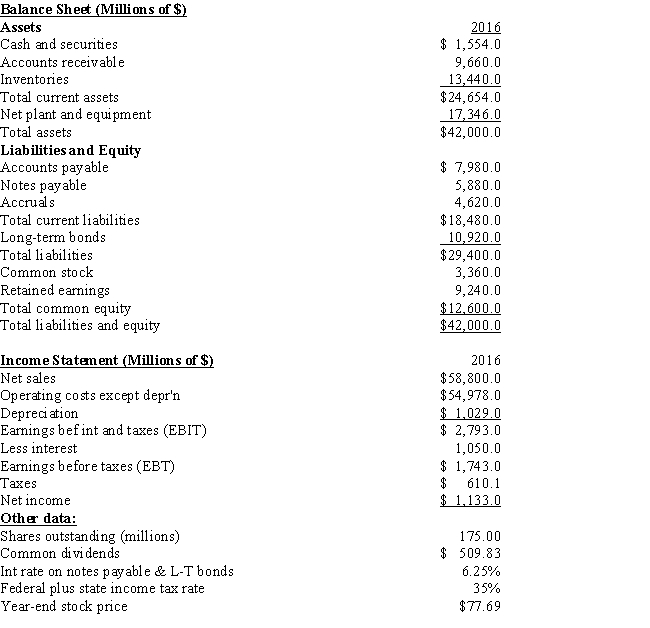

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's P/E ratio?

-Refer to the data for Pettijohn Inc. What is the firm's P/E ratio?

A) 12.0

B) 12.6

C) 13.2

D) 13.9

E) 14.6

Correct Answer

verified

Correct Answer

verified

Multiple Choice

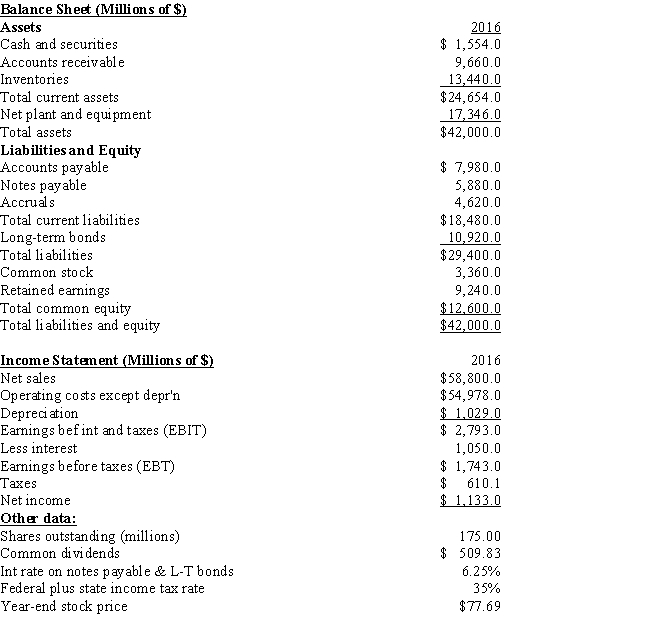

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's TIE?

-Refer to the data for Pettijohn Inc. What is the firm's TIE?

A) 1.94

B) 2.15

C) 2.39

D) 2.66

E) 2.93

Correct Answer

verified

Correct Answer

verified

True/False

The inventory turnover and current ratio are related. The combination of a high current ratio and a low inventory turnover ratio, relative to industry norms, suggests that the firm has an above-average inventory level and/or that part of the inventory is obsolete or damaged.

Correct Answer

verified

Correct Answer

verified

True/False

The times-interest-earned ratio is one, but not the only, indication of a firm's ability to meet its long-term and short-term debt obligations.

Correct Answer

verified

Correct Answer

verified

True/False

Market value ratios provide management with an indication of how investors view the firm's past performance and especially its future prospects.

Correct Answer

verified

Correct Answer

verified

True/False

The inventory turnover ratio and days sales outstanding (DSO) are two ratios that are used to assess how effectively a firm is managing its assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Considered alone, which of the following would increase a company's current ratio?

A) An increase in accounts payable.

B) An increase in net fixed assets.

C) An increase in accrued liabilities.

D) An increase in notes payable.

E) An increase in accounts receivable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Swensen Corp. had sales of $303,225, operating costs of $267,500, and year-end assets of $195,000. The debt-to-total-assets ratio was 27%, the interest rate on the debt was 8.2%, and the firm's tax rate was 37%. The new CFO wants to see how the ROE would have been affected if the firm had used a 45% debt ratio. Assume that sales and total assets would not be affected, and that the interest rate and tax rate would both remain constant. By how much would the ROE change in response to the change in the capital structure?

A) 2.08%

B) 2.32%

C) 2.57%

D) 2.86%

E) 3.14%

Correct Answer

verified

Correct Answer

verified

Multiple Choice

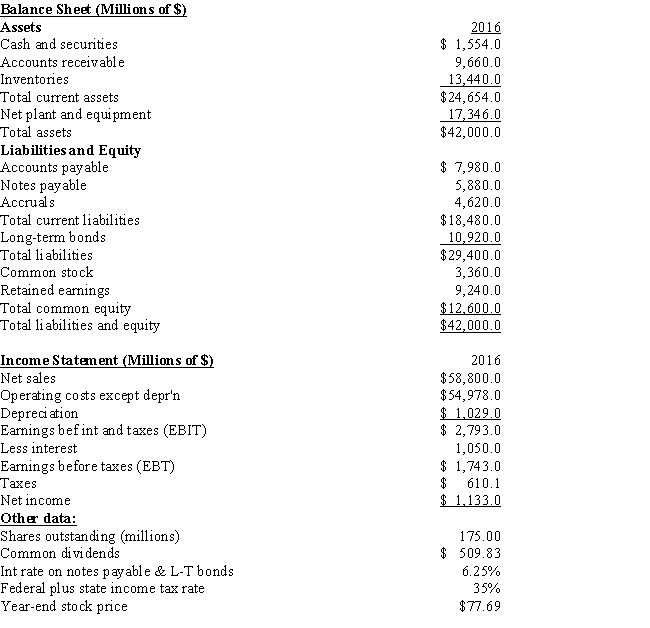

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's inventory turnover ratio?

-Refer to the data for Pettijohn Inc. What is the firm's inventory turnover ratio?

A) 4.17

B) 4.38

C) 4.59

D) 5.82

E) 5.07

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies Heidee and Leaudy have the same sales, tax rate, interest rate on their debt, total assets, and basic earning power. Both companies have positive net incomes. Company Heidee has a higher debt ratio and, therefore, a higher interest expense. Which of the following statements is CORRECT?

A) Company Heidee has more net income.

B) Company Heidee pays less in taxes.

C) Company Heidee has a lower equity multiplier.

D) Company Heidee has a higher ROA.

E) Company Heidee has a higher times interest earned (TIE) ratio.

Correct Answer

verified

Correct Answer

verified

True/False

Although a full liquidity analysis requires the use of a cash budget, the current and quick ratios provide fast and easy-to-use measures of a firm's liquidity position.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lincoln Industries' current ratio is 0.5. Considered alone, which of the following actions would increase the company's current ratio?

A) Use cash to reduce long-term bonds outstanding.

B) Borrow using short-term notes payable and use the cash to increase inventories.

C) Use cash to reduce accruals.

D) Use cash to reduce accounts payable.

E) Use cash to reduce short-term notes payable.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

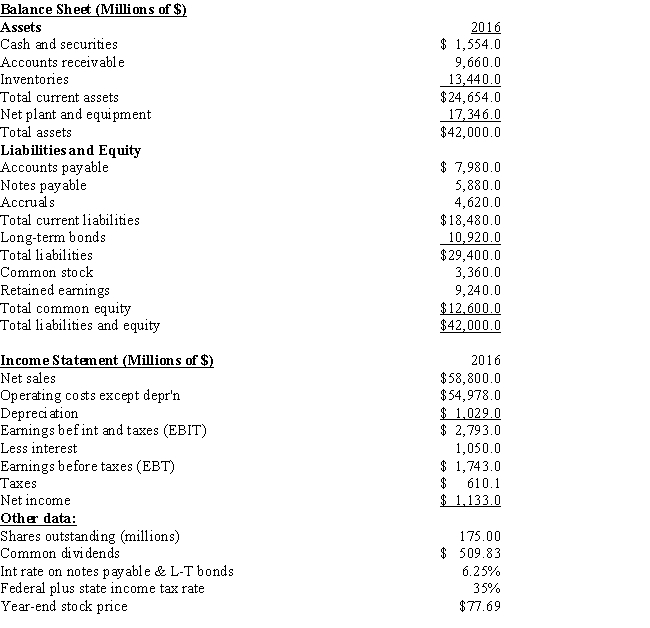

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc. What is the firm's BEP?

-Refer to the data for Pettijohn Inc. What is the firm's BEP?

A) 6.00%

B) 6.32%

C) 6.65%

D) 6.98%

E) 7.33%

Correct Answer

verified

Correct Answer

verified

True/False

Firms A and B have the same current ratio, 0.75, the same amount of sales and cost of goods sold, and the same amount of current liabilities. However, Firm A has a higher inventory turnover ratio than B. Therefore, we can conclude that A's quick ratio must be smaller than B's.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies Heidee and Leaudy are virtually identical in that they are both profitable, and they have the same total assets (TA) , Sales (S) , return on assets (ROA) , and profit margin (PM) . However, Company Heidee has the higher debt ratio. Which of the following statements is CORRECT?

A) Company Heidee has a lower operating income (EBIT) than Company LD.

B) Company Heidee has a lower total assets turnover than Company Leaudy.

C) Company Heidee has a lower equity multiplier than Company Leaudy.

D) Company Heidee has a higher fixed assets turnover than Company Leaudy.

E) Company Heidee has a higher ROE than Company Leaudy.

Correct Answer

verified

Correct Answer

verified

True/False

The basic earning power ratio (BEP) reflects the earning power of a firm's assets after giving consideration to financial leverage and tax effects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Emerson Inc.'s would like to undertake a policy of paying out 45% of its income. Its latest net income was $1,250,000, and it had 225,000 shares outstanding. What dividend per share should it declare?

A) $2.14

B) $2.26

C) $2.38

D) $2.50

E) $2.63

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 104

Related Exams