A) Sales, $1,000; Inventory, $800

B) Cash, $1,000; Cost of Goods Sold, $800

C) Cash, $800; Cost of Goods Sold, $1,000

D) Sales, $800; Inventory, $800

Correct Answer

verified

Correct Answer

verified

True/False

To record the cost of inventory sold under a perpetual inventory, a debit to Cost of Goods Sold and a credit to Inventory is required.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a merchandising business, gross profit is equal to sales revenue minus:

A) cost of goods sold, operating expenses and prepaid expenses combined.

B) cost of goods sold and operating expenses combined.

C) cost of goods sold only.

D) cost of goods sold and sales commissions combined.

Correct Answer

verified

Correct Answer

verified

True/False

Beginning inventory and ending inventory have opposite effects on cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

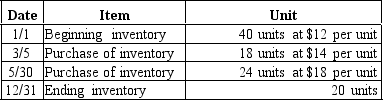

Given the following data, calculate the gross profit using the average-cost method, if the selling price was $20 per unit.

A) $851.71

B) $634.78

C) $359.60

D) $283.90

Correct Answer

verified

Correct Answer

verified

True/False

Using the lower-of-cost-or-market rules to value ending inventory complies with the ongoing principles of accounting.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost-of-goods sold model is:

A) beginning inventory, plus purchases, plus ending inventory equals cost of goods sold.

B) beginning inventory, less purchases, less ending inventory equals cost of goods sold.

C) beginning inventory, plus purchases, less ending inventory equals cost of goods sold.

D) beginning inventory, less purchases, plus ending inventory equals cost of goods sold

Correct Answer

verified

Correct Answer

verified

True/False

When applying the lower-of-cost-or-market rules to beginning inventory valuation, market value generally refers to the cost at which the company can sell a unit of inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory turnover is calculated as:

A) cost of goods sold minus ending inventory.

B) cost of goods sold divided by average inventory.

C) average inventory divided by cost of goods sold.

D) average inventory multiplied by cost of goods sold.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the cost of goods sold is understated for the year, then:

A) ending inventory is understated for the year.

B) ending inventory is overstated for the year.

C) there is no effect on ending inventory for the year.

D) none of the above is true.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are reasons for choosing the FIFO versus the LIFO costing method EXCEPT that:

A) FIFO reports the most up-to-date inventory values on the balance sheet.

B) FIFO generally results in higher net income in period of rising prices.

C) FIFO uses more current costs in calculating the value of ending inventory.

D) FIFO results in lower income taxes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principle that can be summarized as "anticipate no gains, but provide for all possible losses and if in doubt, record an asset at the lowest reasonable amount and report a liability at the highest reasonable amount" is the:

A) revenue concept.

B) accounting conservatism principle.

C) the materiality principle.

D) disclosure principle.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ending inventory for the year ended December 31, 2010, is overstated by $10,000. How will this affect net income for 2011?

A) Net income for 2011 will be understated by $10,000.

B) Net income for 2011 will be overstated by $10,000.

C) Net income for 2011 will be understated by $20,000.

D) Net income for 2011 will be overstated by $20,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

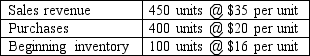

The following data was extracted from the records of Winsam Company:  Winsam's most recent balance sheet showed ending inventory of $800. Which method was used for valuing inventory?

Winsam's most recent balance sheet showed ending inventory of $800. Which method was used for valuing inventory?

A) FIFO

B) LIFO

C) Average-cost

D) Specific identification

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest expense on the income statement for most merchandising companies is:

A) administrative expenses.

B) selling expenses.

C) cost of goods sold.

D) other expenses.

Correct Answer

verified

Correct Answer

verified

True/False

The cost-of-goods-sold model is extremely powerful because it captures all the inventory information for an entire accounting period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charles Scrab Inc has beginning inventory of $15,000, purchases of $25,000, and ending inventory of $10,000, sales of $75,000, operating expenses of $30,000, and a tax rate of 40% for 2010. An accounting clerk input the ending inventory as $12,000. What is the effect on 2011 net income?

A) Net income for 2011 will be $1,200 higher than 2010.

B) Net income for 2011 will be $1,200 lower than 2010.

C) Net income for 2011 will be $10,200.

D) Net income for 2011 cannot be calculated with the information given.

Correct Answer

verified

Correct Answer

verified

True/False

Companies may choose to determine the cost of goods sold using the lower-of-cost-or-market rule.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a perpetual inventory system, when a sale is made:

A) the company makes a journal entry to record the sale only.

B) the company makes a journal entry to record only the cost of goods sold.

C) the company makes a journal entry to record the sale and the cost of goods sold.

D) no journal entry needs to be made.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An indication of how quickly inventory is sold is the:

A) gross profit percentage.

B) cost-of-goods-sold model.

C) inventory turnover.

D) gross margin percentage.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 133

Related Exams