A) A charge account payment

B) A mortgage

C) An installment loan

D) An amount due for taxes

E) The amount due on a credit card

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A family with $70,000 in assets and $22,000 of liabilities would have a net worth of:

A) $70,000.

B) $22,000.

C) $48,000

D) $92,000.

E) $41,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The current financial position of an individual or family is best presented with the use of a(n)

A) budget.

B) cash flow statement.

C) balance sheet.

D) bank statement.

E) time value of money report.

Correct Answer

verified

Correct Answer

verified

True/False

Most income tax documents and records should be kept in a safety deposit box.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A five-year non-redeemable GIC is classified as a(n) _______________ asset on the personal balance sheet.

A) liquid

B) investment

C) personal

D) business

E) marketable

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Janice spends a total of $1,500 a month to cover all living expenses.Which of the following would represent the appropriate emergency fund?

A) $1,500 to $4,500

B) $3,000 to $7,500

C) $4,500 to $9,000

D) $5,000 to $10,000

E) $6,000 to $12,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the past month,Jennifer Sinnet had income of $3,500 and a decrease in net worth of $200.This means Jennifer's payments for the month were:

A) $3,700.

B) $3,300.

C) $2,800.

D) $1,000.

E) $200.

Correct Answer

verified

Correct Answer

verified

True/False

Insolvency is the inability to pay debts by the due date,because liabilities exceed the value of assets.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

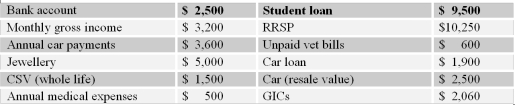

Given the following,what is the individual's net worth?

A) $11,810

B) $11,410

C) $10,910

D) $6,810

E) $6,500

Correct Answer

verified

Correct Answer

verified

True/False

Take-home pay is a person's earnings after deductions for taxes and other items.

Correct Answer

verified

Correct Answer

verified

True/False

If budgeted spending is less than actual spending,this is referred to as a deficit.

Correct Answer

verified

Correct Answer

verified

True/False

Most Canadians have an adequate savings for emergencies.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A common deduction from a person's paycheck is for

A) interest.

B) unemployment

C) rent.

D) taxes.

E) current liabilities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total earnings of a person less deductions for taxes and other items is called

A) budgeted income.

B) gross pay.

C) net worth.

D) total revenue.

E) take-home pay.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities differ from long-term liabilities based on

A) the amount owed.

B) the financial situation of the creditor.

C) the interest rate charged.

D) when the debt is due.

E) current economic conditions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are considered to be personal financial statements?

A) Budget and credit card statements

B) Balance sheet and cash flow statement

C) Checkbook and budget

D) Tax returns

E) Bank statement and savings passbook

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A personal balance sheet presents

A) items owned and amounts owed.

B) income and expenses for a period of time.

C) earnings on savings and investments.

D) amounts budgeted for spending

E) family financial goals.

Correct Answer

verified

Correct Answer

verified

True/False

Definite financial obligations are referred to as variable expenses.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Crown family has a difficult time staying on a budget.In an effort to actually see what funds are available for various expenses,a ____________ budget would be most appropriate.

A) written

B) computerized

C) physical

D) deficit

E) mental

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Opportunity cost refers to:

A) current spending habits.

B) changing economic conditions that affect a person's cost of living.

C) storage facilities to make financial documents easily available.

D) trade-offs associated with financial decisions.

E) avoiding the use of consumer credit.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 75

Related Exams