A) automobiles.

B) aluminum.

C) robots.

D) All of the above are correct.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

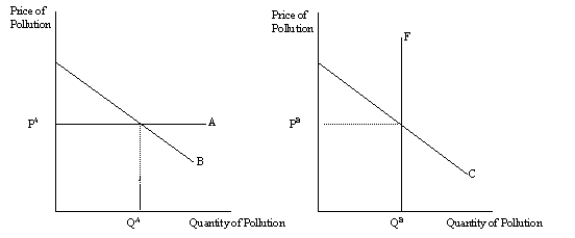

Figure 10-15  -Refer to Figure 10-15.Which graph illustrates a corrective tax?

-Refer to Figure 10-15.Which graph illustrates a corrective tax?

A) the left graph

B) the right graph

C) both graphs

D) neither graph

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When technology spillover occurs,

A) it is the government's responsibility to own firms that are engaged in high-tech research.

B) a firm's research yields technological knowledge that can then be used by society as a whole.

C) those firms engaged in technology research should be taxed by the government.

D) firms invest in the latest production technology and the cost of that technology "spills over" to the prices consumers must pay for the product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

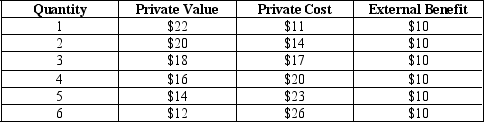

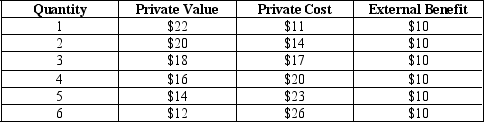

Table 10-3

-Refer to Table 10-3.The table represents a market in which

-Refer to Table 10-3.The table represents a market in which

A) there is no externality.

B) there is a positive externality.

C) there is a negative externality.

D) The answer cannot be determined from inspection of the table.

Correct Answer

verified

Correct Answer

verified

True/False

The concept of external benefit is associated with a negative externality,but not with a positive externality.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flu shots provide a positive externality.Suppose that the market for vaccinations is perfectly competitive.Without government intervention in the vaccination market,which of the following statements is correct?

A) At the current output level,the marginal social benefit exceeds the marginal private benefit.

B) The current output level is inefficiently low.

C) A per-shot subsidy could turn an inefficient situation into an efficient one.

D) All of the above are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

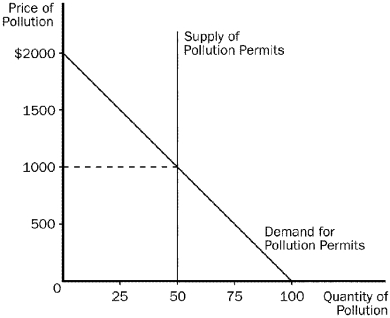

Figure 10-16  -Refer to Figure 10-16.This graph shows the market for pollution when permits are issued to firms and traded in the marketplace.In the absence of a pollution permit system,the quantity of pollution would be

-Refer to Figure 10-16.This graph shows the market for pollution when permits are issued to firms and traded in the marketplace.In the absence of a pollution permit system,the quantity of pollution would be

A) 25

B) 50

C) 75

D) 100

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 10-3

-Refer to Table 10-3.The socially optimal quantity of output is

-Refer to Table 10-3.The socially optimal quantity of output is

A) 3 units.

B) 4 units.

C) 5 units.

D) 6 units.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

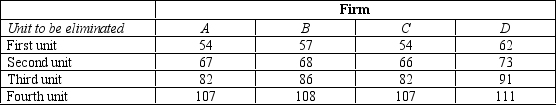

Table 10-5

The following table shows the marginal costs for each of four firms (A,B,C,and D) to eliminate units of pollution from their production processes.For example,for Firm A to eliminate one unit of pollution,it would cost $54,and for Firm A to eliminate a second unit of pollution it would cost an additional $67.

-Refer to Table 10-5.If the government charged a fee of $84 per unit of pollution,how many units of pollution would the firms eliminate altogether?

-Refer to Table 10-5.If the government charged a fee of $84 per unit of pollution,how many units of pollution would the firms eliminate altogether?

A) 7

B) 8

C) 9

D) 10

Correct Answer

verified

Correct Answer

verified

Multiple Choice

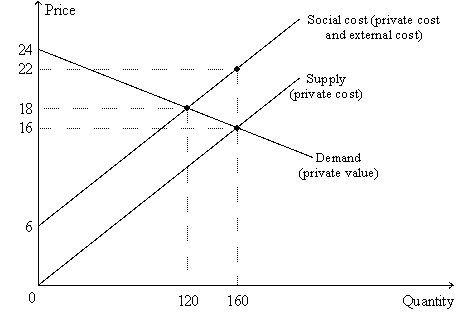

Figure 10-10  -Refer to Figure 10-10.A decrease in output from 160 units to 120 units would

-Refer to Figure 10-10.A decrease in output from 160 units to 120 units would

A) move the market from a socially efficient outcome to a socially inefficient outcome.

B) reduce the external cost per unit of output.

C) increase total economic well-being.

D) not be an action of which a benevolent social planner would approve.

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

When the social cost curve is above a product's supply curve,

A) the government has intervened in the market.

B) a negative externality exists in the market.

C) a positive externality exists in the market.

D) the distribution of resources is unfair.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

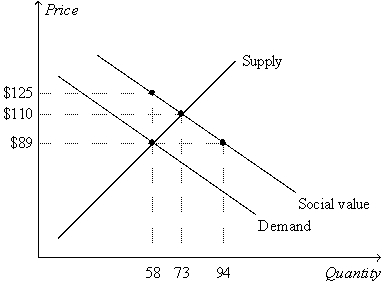

Figure 10-19  -Refer to Figure 10-19.Note that the lines labeled "Demand" and "Social Value"are parallel.Also,the slopes of the lines on the graph reflect the following facts: (1) Private value and social value decrease by $1.00 with each additional unit of the good that is consumed,and (2) private cost increases by $1.40 with each additional unit of the good that is produced.Thus,when the 74th unit of the good is produced and consumed,social well-being

-Refer to Figure 10-19.Note that the lines labeled "Demand" and "Social Value"are parallel.Also,the slopes of the lines on the graph reflect the following facts: (1) Private value and social value decrease by $1.00 with each additional unit of the good that is consumed,and (2) private cost increases by $1.40 with each additional unit of the good that is produced.Thus,when the 74th unit of the good is produced and consumed,social well-being

A) decreases by $2.40.

B) decreases by $1.60.

C) increases by $1.00.

D) increases by $1.40.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In some cases,tradable pollution permits may be better than a corrective tax because

A) pollution permits allow for a market solution while a corrective tax does not.

B) pollution permits generate more revenue for the government than a corrective tax.

C) pollution permits are never preferred over a corrective tax.

D) the government can set a maximum level of pollution using permits.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A command-and-control policy is another term for a

A) pollution permit.

B) government regulation.

C) corrective tax.

D) Both a and b are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The proposition that if private parties can bargain without cost over the allocation of resources,they can solve the problem of externalities on their own,is called

A) the Pigovian theorem.

B) a corrective tax.

C) the externality theorem.

D) the Coase theorem.

Correct Answer

verified

D

Correct Answer

verified

True/False

Corrective taxes are more efficient than regulations for keeping the environment clean.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that flu shots create a positive externality equal to $12 per shot.Further suppose that the government offers a $15 per-shot subsidy to producers.What is the relationship between the equilibrium quantity and the socially optimal quantity of flu shots produced?

A) They are equal.

B) The equilibrium quantity is greater than the socially optimal quantity.

C) The equilibrium quantity is less than the socially optimal quantity.

D) There is not enough information to answer the question.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An externality arises when a person engages in an activity that influences the well-being of

A) buyers in the market for that activity and yet neither pays nor receives any compensation for that effect.

B) sellers in the market for that activity and yet neither pays nor receives any compensation for that effect.

C) bystanders in the market for that activity and yet neither pays nor receives any compensation for that effect.

D) Both (a) and (b) are correct.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A negative externality

A) is a cost to a bystander.

B) is a cost to the buyer.

C) is a cost to the seller.

D) exists with all market transactions.

Correct Answer

verified

Correct Answer

verified

True/False

When correcting for an externality,command-and-control policies are always preferable to market-based policies.

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 439

Related Exams