A) Division managers will be limited to accepting a single new project each.

B) Division managers are being given blanket approval to accept all positive net present value projects.

C) Divisions managers will vie with each other for additional capital allocations.

D) Division managers will not receive any funding for new projects but will be allowed to expand current operations.

E) Division managers will not receive capital funding for any project.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Turner Industries started a new project three months ago.Sales arising from this project are exceeding all expectations.Given this,which one of the following is management most apt to implement?

A) Option to wait

B) Soft rationing

C) Strategic option

D) Option to abandon

E) Option to expand

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rock Haven has a proposed project that will generate sales of 1,680 units annually at a selling price of $22 each.The fixed costs are $12,700 and the variable costs per unit are $5.95.The project requires $28,000 of fixed assets that will be depreciated on a straight-line basis to a zero book value over the four-year life of the project.The salvage value of the fixed assets is $6,900 and the tax rate is 34 percent.What is the operating cash flow for year 4?

A) $11,794

B) $12,417

C) $14,258

D) $16,348

E) $16,971

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A new project you are considering is expected to generate an operating cash flow of $45,620 and will initially free up $22,000 in net working capital.Purchases of fixed assets costing $68,800 will be required to start up the project.What is the total cash flow for this project at time zero?

A) -$68,800

B) -$46,800

C) -$1,040

D) -$26,580

E) -$41,220

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debt-free firm has net income of $228,400,taxes of $46,200,and depreciation of $21,300.What is the operating cash flow?

A) $182,200

B) $103,500

C) $107,100

D) $249,700

E) $295,900

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost-cutting project will decrease costs by $58,500 a year.The annual depreciation on the project's fixed assets will be $10,300 and the tax rate is 34 percent.What is the amount of the change in the firm's operating cash flow resulting from this project?

A) $24,552

B) $26,791

C) $25,805

D) $38,610

E) $42,112

Correct Answer

verified

Correct Answer

verified

Multiple Choice

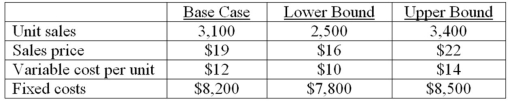

You are analyzing a project and have developed the following estimates.The depreciation is $7,600 a year and the tax rate is 34 percent.What is the worst-case operating cash flow?

A) -$1,311

B) -$641

C) $274

D) $599

E) $1,206

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has an initial requirement of $698,700 for fixed assets and $61,000 for net working capital.The fixed assets will be depreciated to a zero book value over the four-year life of the project and will be worthless at the end of the project.All of the net working capital will be recouped after four years.The expected annual operating cash flow is $218,000.What is the project's internal rate of return if the tax rate is 35 percent?

A) 7.72 percent

B) 8.41 percent

C) 8.69 percent

D) 9.11 percent

E) 9.97 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hunter's Lodge purchased $578,000 of equipment four years ago.The equipment is seven-year MACRS property.The firm is selling this equipment today for $199,500.What is the aftertax cash flow from this sale if the tax rate is 35 percent? The MACRS allowance percentages are as follows,commencing with year 1: 14) 29,24.49,17.49,12.49,8.93,8.92,8.93,and 4.46 percent.

A) $153,869.81

B) $158,114.81

C) $198,410.18

D) $209,740.81

E) $216,610.81

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mike's Fish Market is implementing a project that will initially increase accounts payable by $4,600,increase inventory by $4,800,and decrease accounts receivable by $800.All net working capital will be recouped when the project terminates.What is the cash flow related to the net working capital for the last year of the project?

A) -$2,000

B) -$400

C) -$600

D) $200

E) $2,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Industrial Services is analyzing a proposed investment that would initially require $538,000 of new equipment.This equipment would be depreciated on a straight-line basis to a zero balance over the four-year life of the project.The estimated salvage value is $187,000.The project requires $39,000 initially for net working capital,all of which will be recouped at the end of the project.The projected operating cash flow is $194,900 a year.What is the internal rate of return on this project if the relevant tax rate is 34 percent?

A) 15.54 percent

B) 15.92 percent

C) 18.01 percent

D) 18.67 percent

E) 20.49 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will increase the operating cash flow as computed using the tax shield approach?

A) Decrease in depreciation

B) Decrease in sales

C) Increase in variable costs

D) Decrease in fixed costs

E) Increase in the tax rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Three years ago,Stock Tek purchased some five-year MACRS property for $67,400.Today,it is selling this property for $28,000.How much tax will the firm owe on this sale if the tax rate is 35 percent? The MACRS allowance percentages are as follows,commencing with year 1: 20) 00,32.00,19.20,11.52,11.52,and 5.76 percent.

A) -$3,006

B) -$1,480

C) $0

D) $1,480

E) $3,006

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Travel America Coaches currently sells 15,000 motor homes per year at $94,000 each,and 1,500 luxury motor coaches per year at $159,000 each.The company wants to introduce a low-range camper to fill out its product line; it hopes to sell 6,000 of these campers per year at $14,500 each.An independent consultant has determined that if Travel Coaches introduces the new campers,it should boost the sales of its existing motor homes by 1,500 units per year,and reduce the sales of its luxury motor coaches by 450 units per year.What amount should be used as the annual sales figure when evaluating this project?

A) $87,000,000

B) $97,400,000

C) $156,450,000

D) $186,750,000

E) $228,000,000

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project has sales of $462,000,costs of $274,000,depreciation of $26,000,interest expense of $3,400,and a tax rate of 35 percent.What is the value of the depreciation tax shield?

A) $9,100

B) $9,564

C) $10,650

D) $10,800

E) $11,350

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider an asset that costs $465,000 and is depreciated straight-line to zero over its six-year tax life.The asset is to be used in a four-year project; at the end of the project,the asset can be sold for $120,000.If the relevant tax rate is 35 percent,what is the aftertax cash flow from the sale of this asset?

A) $132,250

B) $155,000

C) $116,500

D) $97,600

E) $79,200

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Sausage Hut is looking at a new sausage system with an installed cost of $438,000.This cost will be depreciated straight-line to zero over the project's four-year life,at the end of which the sausage system can be scrapped for $69,000.The sausage system will save the firm $129,000 per year in pretax operating costs,and the system requires an initial investment in net working capital of $29,000,which will be recouped at project end.If the tax rate is 35 percent and the discount rate is 9 percent,what is the NPV of this project?

A) -$18,870

B) -$6,320

C) $2,560

D) $14,410

E) $26,880

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are analyzing a project and have developed the following estimates: unit sales = 1,320,price per unit = $79,variable cost per unit = $43,fixed costs = $24,900.The depreciation is $11,300 a year and the tax rate is 40 percent.What effect would an increase of $1 in the selling price have on the operating cash flow?

A) $792

B) $1,249

C) $1,320

D) $1,406

E) $1,433

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Better Chocolates has a new project that requires $975,000 of equipment.What is the depreciation in year 6 of this project if the equipment is classified as seven-year property for MACRS purposes? The MACRS allowance percentages are as follows,commencing with year 1: 14) 29,24.49,17.49,12.49,8.93,8.92,8.93,and 4.46 percent.

A) $77,294

B) $77,301

C) $82,988

D) $86,970

E) $139,327

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability to delay an investment:

A) is commonly referred to as the best-case scenario.

B) is valuable provided there are conditions under which the investment will have a positive net present value.

C) ensures that the investment will have an expected net present value that is positive.

D) offsets the need to conduct sensitivity analysis.

E) is referred to as the option to abandon.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 111

Related Exams