A) $375,000

B) $400,000

C) $475,000

D) It cannot be determined from the information provided.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 15-1

Consider a transportation corporation named C.R.Evans that has just completed the development of a new subway system in a medium-sized town in the Northwest.Currently,there are plenty of seats on the subway,and it is never crowded.Its capacity far exceeds the needs of the city.After just a few years of operation,the shareholders of C.R.Evans experienced incredible rates of return on their investment,due to the profitability of the corporation.

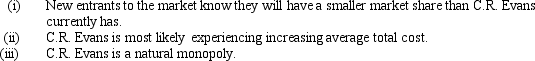

-Refer to Scenario 15-1.Which of the following statements are most likely to be true?

A) (i) and (ii) only

B) (ii) and (iii) only

C) (i) and (iii) only

D) (i) ,(ii) ,and (iii)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The economic inefficiency of a monopolist can be measured by the

A) number of consumers who are unable to purchase the product because of its high price.

B) excess profit generated by monopoly firms.

C) poor quality of service offered by monopoly firms.

D) deadweight loss.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fundamental cause of monopoly is

A) incompetent management in competitive firms.

B) the zero-profit feature of long-run equilibrium in competitive markets.

C) advertising.

D) barriers to entry.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 15-2 A monopoly firm maximizes its profit by producing Q = 500 units of output.At that level of output,its marginal revenue is $30,its average revenue is $60,and its average total cost is $34. -Refer to Scenario 15-2.At Q = 500,the firm's total revenue is

A) $13,000.

B) $15,000.

C) $17,000.

D) $30,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

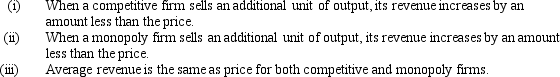

Which of the following statements is true?

A) (ii) only

B) (iii) only

C) (i) and (ii) only

D) (ii) and (iii) only

Correct Answer

verified

Correct Answer

verified

True/False

A monopolist produces where P = MC = MR.

Correct Answer

verified

Correct Answer

verified

Showing 421 - 427 of 427

Related Exams