A) Taxes levied on sellers and taxes levied on buyers are not equivalent.

B) A tax places a wedge between the price that buyers pay and the price that sellers receive.

C) The wedge between the buyers' price and the sellers' price is the same,regardless of whether the tax is levied on buyers or sellers.

D) In the new after-tax equilibrium,buyers and sellers share the burden of the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a tax on a good,then the quantity of the good sold will

A) increase.

B) decrease.

C) not change.

D) All of the above are possible.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

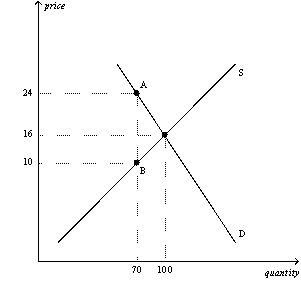

Figure 6-13

The vertical distance between points A and B represents the tax in the market.  -Refer to Figure 6-13.The per-unit burden of the tax on buyers is

-Refer to Figure 6-13.The per-unit burden of the tax on buyers is

A) $6.

B) $8.

C) $14.

D) $24.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the demand for picture frames is elastic and the supply of picture frames is inelastic.A tax of $1 per frame levied on picture frames will increase the price paid by buyers of picture frames by

A) less than $0.50.

B) $0.50.

C) between $0.50 and $1.

D) $1.

Correct Answer

verified

Correct Answer

verified

True/False

Prices are inefficient rationing devices.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is currently a tax of $50 per ticket on airline tickets.Buyers of airline tickets are required to pay the tax to the government.If the tax is reduced from $50 per ticket to $30 per ticket,then

A) the demand curve will shift upward by $20,and the price paid by buyers will decrease by less than $20.

B) the demand curve will shift upward by $20,and the price paid by buyers will decrease by $20.

C) the supply curve will shift downward by $20,and the effective price received by sellers will increase by less than $20.

D) the supply curve will shift downward by $20,and the effective price received by sellers will increase by $20.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on sellers will

A) shift the demand curve upwards by the amount of the tax.

B) shift the demand curve downwards by the amount of the tax.

C) shift the supply curve upwards by the amount of the tax.

D) shift the supply curve downwards by the amount of the tax.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of cell phones,

A) the size of the cell phone market and the price paid by buyers both decrease.

B) the size of the cell phone market decreases,but the price paid by buyers increases.

C) the size of the cell phone market increases,but the price paid by buyers decreases.

D) the size of the cell phone market and the price paid by buyers both increase.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An outcome that can result from either a price ceiling or a price floor is

A) a surplus in the market.

B) a shortage in the market.

C) a nonbinding price control.

D) long lines of frustrated buyers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

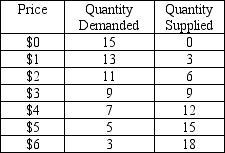

Table 6-3

The following table contains the demand schedule and supply schedule for a market for a particular good.Suppose sellers of the good successfully lobby Congress to impose a price floor $2 above the equilibrium price in this market.

-Refer to Table 6-3.Following the imposition of a price floor $2 above the equilibrium price,irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor.The resulting market price is

-Refer to Table 6-3.Following the imposition of a price floor $2 above the equilibrium price,irate buyers convince Congress to repeal the price floor and to impose a price ceiling $1 below the former price floor.The resulting market price is

A) $2.

B) $3.

C) $4.

D) $5.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

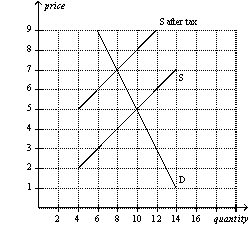

Figure 6-12  -Refer to Figure 6-12.Which of the following is correct?

-Refer to Figure 6-12.Which of the following is correct?

A) One-fourth of the burden of the tax falls on buyers and three-fourths of the burden of the tax falls on sellers.

B) One-third of the burden of the tax falls on buyers and two-thirds of the burden of the tax falls on sellers.

C) One-half of the burden of the tax falls on buyers and one-half of the burden of the tax falls on sellers.

D) Two-thirds of the burden of the tax falls on buyers and one-third of the burden of the tax falls on sellers.

Correct Answer

verified

Correct Answer

verified

True/False

The economy contains many labor markets for different types of workers.

Correct Answer

verified

Correct Answer

verified

True/False

Rent subsidies and wage subsidies are better than price controls at helping the poor because they have no costs associated with them.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The imposition of a binding price floor on a market causes quantity demanded to be

A) greater than quantity supplied.

B) less than quantity supplied.

C) equal to quantity supplied.

D) Both (a) and (b) are possible.

Correct Answer

verified

Correct Answer

verified

True/False

A large majority of economists favor eliminating the minimum wage.

Correct Answer

verified

Correct Answer

verified

True/False

A tax of $1 on sellers always increases the equilibrium price by $1.

Correct Answer

verified

Correct Answer

verified

True/False

Whether a tax is levied on sellers or buyers,taxes discourage market activity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is levied on sellers of tea,

A) the well-being of both sellers and buyers of tea is unaffected.

B) sellers of tea are made worse off and the well-being of buyers is unaffected.

C) sellers of tea are made worse off and buyers of tea are made better off.

D) sellers and buyers of tea both are made worse off.

Correct Answer

verified

Correct Answer

verified

True/False

The United States is the only country in the world with minimum-wage laws.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buyers of a good bear the larger share of the tax burden when a tax is placed on a product for which

A) the supply is more elastic than the demand.

B) the demand in more elastic than the supply.

C) the tax is placed on the sellers of the product.

D) the tax is placed on the buyers of the product.

Correct Answer

verified

Correct Answer

verified

Showing 381 - 400 of 459

Related Exams