Correct Answer

verified

Correct Answer

verified

Multiple Choice

The value of money:

A) increases when prices rise

B) increases when the price of bonds falls

C) increases when prices fall

D) decreases when prices fall

Correct Answer

verified

Correct Answer

verified

Multiple Choice

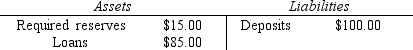

If the reserve requirement is increased to 25 per cent, then the First Bank of Oz:

A) can create money by making a new loan

B) can hold excess reserves

C) cannot make a new loan

D) both B and C

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiat money is:

A) money based on the value of a commodity, such as a car

B) money without intrinsic value

C) commodity money

D) paper or plastic money under gold standard

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the RBA sold government securities, then:

A) the money supply would increase

B) the money supply would not change

C) the money supply would decrease

D) none of the above

Correct Answer

verified

Correct Answer

verified

True/False

Money is the set of assets in the economy that people regularly use to buy goods and services from other people.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The RBA is required to ensure that:

A) prices of all products need to increase by a maximum of 3 per cent per annum

B) target inflation is at 2-3 per cent

C) there is adequate money available for the government's projects

D) all of the above

Correct Answer

verified

Correct Answer

verified

Essay

What are the problems facing the RBA in its management of the money supply?

Correct Answer

verified

a. The RBA does not control the amount of money that households deposit in banks.

b. The RBA cannot control the amount of money that bankers choose to lend.

Correct Answer

verified

Multiple Choice

If the reserve ratio is 20 per cent and a bank receives a new deposit of $100, then this bank:

A) must increase its required reserves by $20

B) will initially see its total reserves increase by $100

C) will be able to make a new loan of $80

D) all of the above

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

A decrease in reserve requirements will likely result in banks:

A) holding fewer reserves

B) making more loans

C) increasing the money supply

D) all of the above

Correct Answer

verified

Correct Answer

verified

Essay

Explain what will happen to the money supply under each of the following circumstances: a. The public decides to increase the amount of currency it holds. b. Banks decide to hold fewer excess reserves.

Correct Answer

verified

a. If the public decides to hold more currency, it can do so only by taking reserves out of the banking system. With fewer reserves in the banking system, there will be less bank money, hence the money supply will fall.

b. If banks decide to hold fewer excess reserves, they will lend more reserves, lowering the reserve ratio and increasing the money multiplier. Additional bank money will be created, and the money supply will increase.

Correct Answer

verified

Multiple Choice

Store of value deteriorates when:

A) when only the cost of fruit and vegetables increases

B) when there are inflationary expectations

C) when there are deflationary expectations

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 10 per cent, the money multiplier is:

A) 10

B) 10 per cent

C) 90 per cent

D) 90

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the reserve ratio is 100 per cent, depositing $500 of paper money in a bank will increase the money supply by:

A) $500

B) $0

C) $5000

D) $500 000

Correct Answer

verified

Correct Answer

verified

True/False

If you deposited $100 of your currency into a bank, and the reserve ratio were 5 per cent, then the banking system could create as much as $1900 in additional money.

Correct Answer

verified

Correct Answer

verified

True/False

A decrease in reserve requirements lowers the reserve ratio, raises the money multiplier and increases the money supply.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bank runs:

A) occur when the discount rate rises

B) occur when large numbers of depositors all try to withdraw their deposits at the same time

C) are only a problem in a 100 per cent reserve banking system

D) none of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about credit cards is correct?

A) Credit cards are a method of payment

B) Credit cards are included in measures of the quantity of money

C) Credit cards are a method of deferring payment

D) Credit cards are considered a form of money

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following balance sheet for the First Bank of Oz:  If $1000 is deposited into the First Bank of Oz, then:

If $1000 is deposited into the First Bank of Oz, then:

A) assets will increase by $1000

B) liabilities will decrease by $1000

C) total reserves will initially increase by $150

D) required reserves will increase by $850

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the RBA is trying to control rising inflation, it:

A) decreases the interest rate that financial institutions can earn on overnight loans of their currency

B) targets inflation is at 2-3 percent

C) increases the interest rate that financial institutions can earn on overnight loans of their currency

D) all of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 66

Related Exams