A) a deposit over $100

B) the money supply divided by the price level

C) the balance in M1

D) the money supply divided by the interest rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

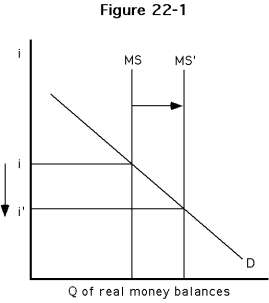

-Refer to Figure. Which of the following could cause the phenomena pictured in the diagram?

-Refer to Figure. Which of the following could cause the phenomena pictured in the diagram?

A) an increase in payments technology

B) an increase in expected inflation

C) an increase in real income

D) an increase in the liquidity of other assets

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many near money substitutes are created. The demand for money will

A) increase.

B) decrease.

C) stay the same.

D) It is impossible to tell.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ceteris paribus, according to Keynes, the speculative motive for holding money shows that the

A) demand for money and the interest rate are directly related.

B) quantity demanded of real money balances and the interest rate are inversely related.

C) quantity demanded of money is directly related to income.

D) demand for money is directly related to income.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Real income is which of the following?

A) nominal income adjusted for changes in prices

B) nominal income multiplied by a price index

C) a price index divided by nominal income

D) a price index multiplied by nominal income

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The immediate response to an increase in the growth rate of the nominal money supply is which of the following?

A) a perfectly proportional decrease in the price level

B) a perfectly proportional increase in the price level

C) a less than proportional decrease in the price level

D) a less than proportional increase in the price level

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The relative interest rate differential between nonmonetary and monetary assets is considered which of the following?

A) real income

B) real money balances

C) liquidity preference

D) the opportunity cost of holding money

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ceteris paribus, when the Fed decreases the supply of reserves, which of the following happens?

A) There is a movement downward on the supply curve for real money balances.

B) There is a movement upward on the supply curve for real money balances.

C) The supply curve of real money balances shifts to the right.

D) The supply curve of real money balances shifts to the left.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be considered a benefit of holding real money balances?

A) interest income on money balances

B) convenience

C) increasing the transactions costs of exchanges

D) the ability to make payments when due

Correct Answer

verified

Correct Answer

verified

Multiple Choice

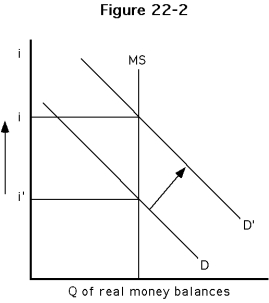

-Refer to Figure . Which of the following may have caused the scenario described in the figure?

-Refer to Figure . Which of the following may have caused the scenario described in the figure?

A) The Fed increased the required reserve ratio.

B) The Fed raised the discount rate.

C) The Fed purchased Treasury securities.

D) The Fed announced a higher target rate for the Fed funds rate.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

ATM machines become more accessible. The supply of money will

A) increase.

B) decrease.

C) stay the same.

D) It is impossible to tell.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true regarding the relationship between the demand and supply of real money balances?

A) An increase in the money supply is likely to lead to a decrease in interest rates; a decrease in interest rates is likely to lead to an increase in real income; an increase is real income is likely to lead to an increase in the demand for real money balances.

B) An increase in the demand for real money balances is likely to lead to an increase in the supply of real money balances.

C) Increases in the supply of real money balances are just as likely to lead to a decrease in the demand for real money balances, as they are to lead to an increase in the demand for real money balances.

D) The demand and supply of real money balances are completely independent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to monetarism, changes in the money supply are the most important factor in determining changes in which of the following variables?

A) nominal GDP

B) real GDP

C) the price level

D) the interest rate

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The __________ suggests that individuals will demand to hold money in anticipation of unforeseen opportunities or threats.

A) speculative demand for money

B) precautionary motive

C) transaction motive

D) liquidity preference theory

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ceteris paribus, if the price level increases by 20 percent,

A) both the nominal demand for money and demand for real balances increases by 20 percent.

B) the nominal demand for money decreases by 20 percent and the demand for real balances decreases.

C) the nominal demand for money increases by 20 percent and the demand for real balances remains the same.

D) both the nominal demand for money and the demand for real balances remains the same.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The __________ suggests that individuals will demand to hold money in anticipation of the need to make payments.

A) speculative demand for money

B) precautionary motive

C) transaction motive

D) liquidity preference theory

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What percentage of currency do some experts estimate is held outside of the United States?

A) 30-40 percent

B) 40-50 percent

C) 50-60 percent

D) 60-70 percent

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ceteris paribus, when real income increases, which of the following happens?

A) The demand curve for money shifts to the right.

B) The demand curve for money shifts to the left.

C) There is a movement downward on the demand curve for money.

D) There is a movement upward on the demand curve for money.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The supply of real money balances increases when

A) the Fed sells securities in the open market.

B) discount loans are paid off at Federal Reserve District Banks.

C) the Fed raises the required reserve ratio.

D) the overall price level falls.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What percentage of United States currency is estimated to be held outside the United States?

A) less than10 percent

B) less than 25 percent

C) over 50 percent

D) more than 80 percent

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 95

Related Exams