A) stocks of companies in a related industry.

B) debt securities.

C) low-risk, highly liquid securities.

D) stock securities.

Correct Answer

verified

Correct Answer

verified

True/False

Consolidated financial statements should be prepared only when a subsidiary company has a controlling interest in the parent company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consolidated financial statements present all of the following except the

A) individual assets and liabilities of the parent company

B) individual assets and liabilities of the subsidiary.

C) total revenues and expenses of the subsidiary.

D) All of these are presented in consolidated financial statements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company acquires a 40% common stock interest in another company,

A) the equity method is usually applicable.

B) all influence is classified as controlling.

C) the cost method is usually applicable.

D) the ability to exert significant influence over the activities of the investee does not exist.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the equity method, the Stock Investments account is increased when the

A) investee company reports net income.

B) investee company pays a dividend.

C) investee company reports a loss.

D) stock investment is sold at a gain.

Correct Answer

verified

Correct Answer

verified

Essay

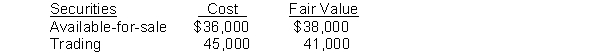

Terra Firma Company has the following data at December 31, 2010 for its securities:

Correct Answer

verified

11eb1696_f5f5_9625_984d_2d6294768802_TB3107_00 Exercises

Correct Answer

verified

Short Answer

At the beginning of the year, Grant Corporation acquired 15% of Ernst Company common stock for $300,000. Ernst Company reported net income for the year of $75,000 and paid $25,000 cash dividends during the year. The balance of the Stock Investments account on the books of Grant Corporation at the end of the year should be $___________.

Correct Answer

verified

Correct Answer

verified

True/False

In accordance with the cost principle, brokerage fees should be added to the cost of an investment.

Correct Answer

verified

Correct Answer

verified

Essay

On January 1, Lance Corporation purchased a 40% equity in Sloan Company for $160,000. At December 31, Sloan declared and paid a $40,000 cash dividend and reported net income of $100,000. Instructions Prepare the necessary journal entries for Lance Corporation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company owns more than 50% of the common stock of another company,

A) affiliated financial statements are prepared.

B) consolidated financial statements are prepared.

C) controlling financial statements are prepared.

D) significant financial statements are prepared.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Noell Corp. has common stock of $5,500,000, retained earnings of $3,000,000, unrealized gains on trading securities of $100,000 and unrealized losses on available-for-sale securities of $200,000. What is the total amount of its stockholders' equity?

A) $8,300,000

B) $8,500,000

C) $8,400,000

D) $8,600,000

Correct Answer

verified

Correct Answer

verified

Short Answer

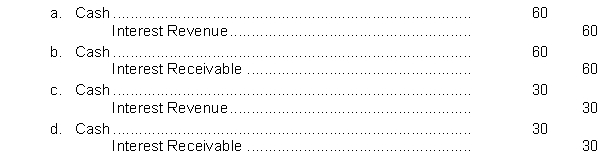

On January 1, 2010, Milton Company purchased at face value, a $1,000, 6% bond that pays interest on January 1 and July 1. Milton Company has a calendar year end.

The entry for the receipt of interest on January 1, 2011 is

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

The cost of debt investments includes each of the following except

A) brokerage fees.

B) commissions.

C) accrued interest.

D) the price paid.

Correct Answer

verified

Correct Answer

verified

Essay

Glaser Company had the following transactions pertaining to debt securities held as a short-term investment. Jan. 1 Purchased 50, 8%, $1,000 Adcock Company bonds for $50,000 cash plus brokerage fees of $800. Interest is payable semiannually on July 1 and January 1. July 1 Received semiannual interest on Adcock Company bonds. Oct. 1 Sold 30 Adcock Company bonds for $32,000 plus accrued interest less $500 brokerage fees. Instructions (a) Journalize the transactions. (b) Prepare the adjusting entry for the accrual of interest on December 31.

Correct Answer

verified

Correct Answer

verified

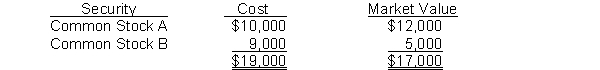

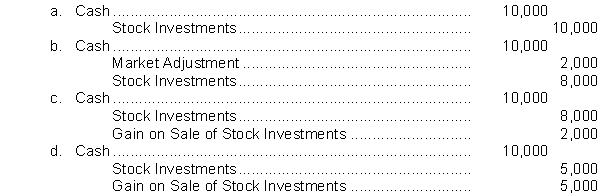

Short Answer

Foley Corporation's trading portfolio at the end of the year is as follows:  Foley subsequently sells Stock B for $10,000. What entry is made to record the sale?

Foley subsequently sells Stock B for $10,000. What entry is made to record the sale?

Correct Answer

verified

Correct Answer

verified

True/False

When debt investments, are sold, the gain or loss is the difference between the net proceeds from the sale and the fair value of the bonds.

Correct Answer

verified

Correct Answer

verified

True/False

In accounting for stock investments of less than 20%, the equity method is used.

Correct Answer

verified

Correct Answer

verified

Short Answer

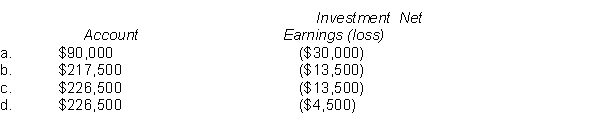

On January 1, 2010, Duvall Industries acquired a 15% interest in Florida Corporation through the purchase of 12,000 shares of Florida Corporation common stock for $240,000. During 2010, Florida Corp. paid $60,000 in dividends and reported a net loss of $90,000. Duvall is able to exert significant influence on Florida. However, Duvall mistakenly records these transactions using the cost method rather than the equity method of accounting. Which of the following would show the correct presentation for Duvall's investment using the equity method?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barr Company acquires 60, 10%, 5 year, $1,000 Community bonds on January 1, 2010 for $61,250. This includes a brokerage commission of $1,250. Assume Community pays interest on January 1 and July 1, and the July 1 entry was done correctly. The journal entry at December 31, 2010 would include a credit to

A) Interest Receivable for $3,000.

B) Interest Revenue for $6,000.

C) Accrued Expense for $6,000.

D) Interest Revenue for $3,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The equity method of accounting for an investment in the common stock of another company should be used by the investor when the investment

A) is composed of common stock and it is the investor's intent to vote the common stock.

B) ensures a source of supply of raw materials for the investor.

C) enables the investor to exercise significant influence over the investee.

D) is obtained by an exchange of stock for stock.

Correct Answer

verified

C

Correct Answer

verified

Showing 1 - 20 of 178

Related Exams