A) $1,280.

B) $1,287.

C) $1,306.

D) $1,330.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

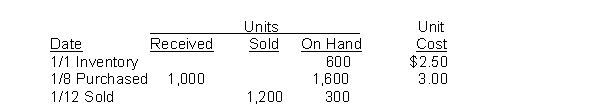

Nick's Place recorded the following data:  The weighted average unit cost of the inventory at January 31 is:

The weighted average unit cost of the inventory at January 31 is:

A) $2.50.

B) $2.75.

C) $2.81.

D) $3.400.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

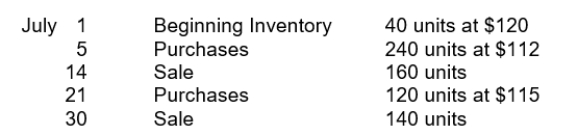

Moroni Industries has the following inventory information.  Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a LIFO basis?

Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a LIFO basis?

A) $11,500

B) $11,520

C) $33,960

D) $33,980

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Understating beginning inventory will understate

A) assets.

B) cost of goods sold.

C) net income.

D) stockholder's equity.

Correct Answer

verified

Correct Answer

verified

True/False

If inventories are valued using the LIFO cost flow assumption, they should not be classified as a current asset on the balance sheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the LCM approach, the market value is defined as

A) FIFO cost.

B) LIFO cost.

C) current replacement cost.

D) selling price.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

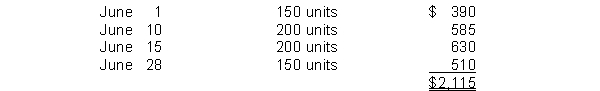

A company just starting business made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand. Using the average-cost method, the amount allocated to the ending inventory on June 30 is

A physical count of merchandise inventory on June 30 reveals that there are 250 units on hand. Using the average-cost method, the amount allocated to the ending inventory on June 30 is

A) $683.

B) $755.

C) $825.

D) $1,360.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of goods available for sale is allocated to the cost of goods sold and the

A) beginning inventory.

B) ending inventory.

C) cost of goods purchased.

D) gross profit.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

LIFO can be used

A) under neither GAAP nor IFRS.

B) under IFRS but not GAAP.

C) under GAAP but not IFRS.

D) under both GAAP and IFRS.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

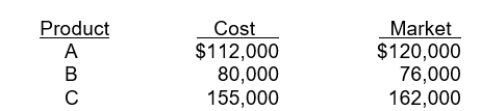

Alfalfa Company developed the following information about its inventories in applying the lower-of-cost-or-market (LCM) basis in valuing inventories:  If Alfalfa applies the LCM basis, the value of the inventory reported on the balance sheet would be

If Alfalfa applies the LCM basis, the value of the inventory reported on the balance sheet would be

A) $343,000.

B) $347,000.

C) $358,000.

D) $362,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost flow method that often parallels the actual physical flow of merchandise is the

A) FIFO method.

B) LIFO method.

C) average-cost method.

D) gross profit method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Selection of an inventory costing method by management does not usually depend on

A) the fiscal year end.

B) income statement effects.

C) balance sheet effects.

D) tax effects.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventories are estimated

A) more frequently under a periodic inventory system than a perpetual inventory system.

B) using the wholesale inventory method.

C) more frequently under a perpetual inventory system than the periodic inventory system.

D) using the net method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The LIFO inventory method assumes that the cost of the latest units purchased are

A) the last to be allocated to cost of goods sold.

B) the first to be allocated to ending inventory.

C) the first to be allocated to cost of goods sold.

D) not allocated to cost of goods sold or ending inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which costing method cannot be used to determine the cost of inventory items before lower-of-cost-or-market is applied?

A) Specific identification

B) FIFO

C) LIFO

D) All of these methods can be used.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If companies have identical inventoriable costs but use different inventory flow assumptions when the price of goods have not been constant, then the

A) cost of goods sold of the companies will be identical.

B) cost of goods available for sale of the companies will be identical.

C) ending inventory of the companies will be identical.

D) net income of the companies will be identical.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be included in the physical inventory of a company?

A) Goods held on consignment from another company.

B) Goods in transit to another company shipped FOB shipping point.

C) Goods in transit from another company shipped FOB shipping point.

D) Goods in transit to or from another company shipped FOB shipping point.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a manufacturing business, inventory that is ready for sale is called

A) raw materials inventory.

B) work in process inventory.

C) finished goods inventory.

D) store supplies inventory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a period of increasing prices, which inventory flow assumption will result in the lowest amount of income tax expense?

A) FIFO

B) LIFO

C) Average Cost

D) Income tax expense for the period will be the same under all assumptions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory is reported in the financial statements at

A) cost.

B) market.

C) the higher-of-cost-or-market.

D) the lower-of-cost-or-market.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 161

Related Exams