A) a reduction in unemployment compensation.

B) a decrease in personal taxes.

C) an increase in government spending.

D) an increase in transfer payments.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When workers lose their job, they file for unemployment benefits; therefore government spending on such programs naturally rises during recessions. As the economy recovers and people go back to work, spending on unemployment programs shrinks. Based on the given information, which of the following is correct?

A) Unemployment benefit programs are an example of discretionary fiscal policy.

B) Unemployment compensation is a form of an automatic stabilizer.

C) The spending on unemployment benefits is designed to increase short-run aggregate supply during recessions.

D) Unemployment benefit programs are an example of a supply-side policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budget philosophy closest in spirit to Keynesian economics is:

A) the cyclically balanced budget.

B) perpetual deficit spending.

C) the annually balanced budget.

D) functional finance.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiscal policy that focuses on shifting the long-run aggregate supply curve to the right is:

A) aggregate shifts policy.

B) contractionary policy.

C) supply-side fiscal policy.

D) consumption policy.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The largest category of federal government spending in 2015 was:

A) defense.

B) Social Security.

C) education.

D) net interest.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Automatic stabilizers include all of the following EXCEPT:

A) unemployment compensation benefits.

B) welfare payments.

C) national defense spending.

D) tax revenues.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The crowding-out effect can drive up interest rates, which _____ consumer spending on durable goods and _____ business investment.

A) reduces; increases

B) reduces; reduces

C) increases; reduces

D) increases; increases

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government borrows money from the Federal Reserve:

A) the quantity of publicly held bonds will rise.

B) the quantity of money in circulation will rise.

C) the quantity of money in circulation will fall.

D) inflation will decrease.

Correct Answer

verified

Correct Answer

verified

True/False

Government spending on public investment is more likely to hurt future generations than is government spending on current consumption.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements do economists generally disagree on?

A) No tax revenues would be collected when average tax rates are 0%.

B) No tax revenues would be collected when average tax rates are 100%.

C) At very high average tax rates, increasing tax rates further would decrease tax revenues.

D) At an average tax rate of 50%, tax revenues are maximized for a government.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

_____ are securities with a maturity period of a year or less that sell at a discount.

A) Treasury bills

B) Treasury notes

C) Treasury bonds

D) U.S. savings bonds

Correct Answer

verified

Correct Answer

verified

True/False

The burden of a nation's debt rises if interest rates fall.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The corporate income tax constitutes _____ of federal government revenues.

A) up to 25%

B) 25% to 50%

C) 50% to 75%

D) zero (there is no corporate income tax at the federal level)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During an economic expansion, automatic stabilizers:

A) help to keep the economy from generating inflationary pressures.

B) add to the growth of GDP.

C) prevent the economy from growing.

D) add to inflationary pressures.

Correct Answer

verified

Correct Answer

verified

True/False

An investment tax credit for pharmaceutical research is a demand-side fiscal policy.

Correct Answer

verified

Correct Answer

verified

True/False

Public choice economists think deficit spending reduces the perceived cost of current government operations and then shifts additional costs to the next generation.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is (are) true? I. As interest rates fall, the burden of the federal deficit is reduced. II) As financial markets become more global in scale, it has reduced the burden of the federal deficit. III) Recent increases in tax revenues due to a growing economy have reduced the federal budget deficit and the national debt.

A) I only

B) I and II only

C) II and III only

D) I, II, and III only

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures is NOT an example of discretionary fiscal policy?

A) The unemployment compensation program pays out more money as the unemployment rate rises.

B) Tax rates are increased in the hope of slowing down the rate of inflation.

C) Tax increases are enacted to reduce the government deficit.

D) Government spending is increased to reduce the problems caused by a recession.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the share of the U.S. national debt that is held by the public, _____ hold nearly ____.

A) foreigners; three times as much as do Americans

B) foreigners; twice as much as do Americans

C) Americans; twice as much as do foreigners

D) foreigners; the same amount as do Americans

Correct Answer

verified

Correct Answer

verified

Multiple Choice

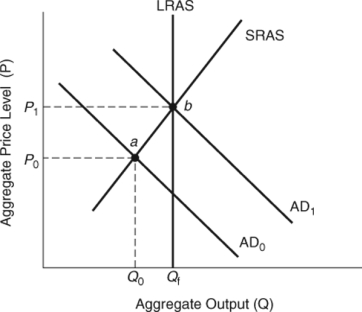

(Figure: Effects of Policy Shifts) If the economy starts below full employment, an expansionary fiscal policy will shift the aggregate demand curve from _____ to _____, and equilibrium will move from point _____ to _____.

A) AD1; AD0; a; b

B) AD1; AD0; b; a

C) AD0; AD1; b; a

D) AD0; AD1; a; b

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 365

Related Exams